401(k) Basics: Everything You Need to Know in 2026

Your employer offers a 401(k). Should you use it? How much should you contribute? What's a match? Here's the complete beginner's guide to the retirement account that could make you a millionaire.

John Mitchell

CFP®, CFA

If you have a job with a 401(k) and you're not using it, you're leaving money on the table. Literally.

I've talked to hundreds of people who delayed enrolling in their 401(k) because it seemed complicated or they figured they'd "get to it later." Every single one of them regretted waiting.

Let's fix that. Here's everything you need to know about the 401(k) — no jargon, no BS.

What Is a 401(k)?

A 401(k) is a retirement savings account offered through your employer. You contribute money from your paycheck before taxes (or after taxes, if it's a Roth 401(k)), and it grows tax-advantaged until you retire.

The name comes from Section 401(k) of the IRS tax code. Riveting, I know. But here's what matters:

- Tax benefits — Your contributions reduce your taxable income

- Employer match — Free money (more on this below)

- Compound growth — Your money grows on top of itself for decades

Traditional vs. Roth 401(k)

Many employers now offer both. Here's the difference:

Traditional 401(k):

- Contributions are pre-tax (reduces your taxable income now)

- You pay taxes when you withdraw in retirement

- Good if you expect to be in a lower tax bracket when you retire

Roth 401(k):

- Contributions are after-tax (no tax break now)

- Withdrawals in retirement are tax-FREE

- Good if you expect to be in the same or higher tax bracket later

My take: If you're young and early in your career, lean toward Roth. You're probably in a relatively low tax bracket now, and decades of tax-free growth is powerful.

If you're in your peak earning years and your tax rate is high, traditional may save you more.

Not sure? Split it 50/50. That's a perfectly reasonable approach.

The Employer Match: Free Money

This is the most important thing to understand about your 401(k).

Many employers will match your contributions up to a certain percentage. Common formulas:

- 100% match up to 3% — You contribute 3% of your salary, they add 3%

- 50% match up to 6% — You contribute 6%, they add 3%

- Dollar-for-dollar up to 4% — You contribute 4%, they add 4%

If your employer offers a match and you're not contributing enough to get the full match, you are literally declining free money. This is the closest thing to guaranteed returns you'll ever find.

Rule #1: Always contribute at least enough to get the full employer match.

If your employer matches 4%, contribute at least 4%. That's an instant 100% return on your money before it even starts growing.

2026 Contribution Limits

The IRS sets annual limits on how much you can contribute:

- Under 50: $23,500 per year (employee contribution)

- 50 and older: $31,000 per year (includes $7,500 catch-up contribution)

These limits don't include employer matching — that's on top.

Most people won't hit the max, and that's okay. Contribute what you can and increase it over time.

How Much Should You Contribute?

The standard advice is 10-15% of your income (including employer match). But let's be realistic:

Minimum: Enough to get the full employer match

Better: 10% of your income

Best: 15%+ if you can swing it

If you're starting late: 20%+ to catch up

Can't do 10% right now? Start with what you can — even 3% is better than nothing. Then increase by 1% every year. You won't notice the small incremental changes in your paycheck, but they compound massively over time.

What Should You Invest In?

Most 401(k)s offer a menu of investment options. Here's the simplified approach:

Option 1: Target Date Fund (Easiest)

Pick the fund closest to your expected retirement year (e.g., "Target 2055" if you plan to retire around 2055). These funds automatically adjust from aggressive to conservative as you age. Set it and forget it.

Option 2: Index Funds (Slightly More Hands-On)

If your plan offers low-cost index funds, a simple allocation might be:

- 80-90% S&P 500 or Total Stock Market index (if you're young)

- 10-20% Bond index

As you get closer to retirement, shift more toward bonds.

What to Avoid:

- High-fee actively managed funds (look for expense ratios under 0.5%)

- Company stock (don't put all your eggs in one basket — your job AND retirement in the same company is risky)

- "Stable value" funds for your entire portfolio (too conservative for long-term growth)

The Power of Starting Early

Let me show you why waiting costs you:

Scenario: Invest $500/month, 7% average annual return

- Start at 25, retire at 65: $1.2 million

- Start at 35, retire at 65: $567,000

- Start at 45, retire at 65: $246,000

The person who started at 25 contributed only $60,000 more than the person who started at 35, but ended up with $633,000 more. That's compound interest doing the heavy lifting.

Common 401(k) Mistakes

1. Not enrolling immediately Every month you delay is a month of lost growth. Enroll on day one of eligibility.

2. Contributing less than the match You're declining free money. Don't do this.

3. Cashing out when you leave a job You'll pay taxes plus a 10% penalty. Roll it into an IRA or your new employer's plan instead.

4. Taking a 401(k) loan Yes, you can borrow from your 401(k). No, you probably shouldn't. You lose out on growth, and if you leave your job, the loan becomes due immediately.

5. Being too conservative when young If you're in your 20s or 30s with decades until retirement, you can afford to ride out market ups and downs. Don't put everything in bonds.

What Happens When You Leave Your Job?

You have options:

- Leave it in the old plan (if the plan allows and you like the investment options)

- Roll it into your new employer's 401(k) (consolidation, simplicity)

- Roll it into an IRA (more investment options, potentially lower fees)

- Cash out (DON'T — taxes + 10% penalty if under 59½)

Option 3 is often the best for flexibility and low costs, especially if you roll into a Fidelity, Schwab, or Vanguard IRA.

The Bottom Line

Your 401(k) is probably the most powerful wealth-building tool you have access to. Tax advantages, employer matching, and decades of compound growth can turn modest contributions into a seven-figure retirement fund.

Start today:

- Log into your employer's benefits portal

- Enroll in the 401(k) (or increase your contribution if you're already in)

- Contribute at least enough to get the full employer match

- Pick a target date fund or low-cost index funds

- Automate and forget about it

Your future self will thank you.

Have questions about your specific 401(k) situation? Drop them in the comments — I read every one.

You May Also Find Interesting

Crypto

CryptoBitcoin for Beginners: What You Need to Know in 2026

Curious about Bitcoin but confused by the jargon? Here's a plain-English guide to what Bitcoin is, how it works, and whether it belongs in your portfolio.

Budgeting

BudgetingHow to Build an Emergency Fund in 2026 (Even If You're Starting From Zero)

57% of Americans can't cover a $1,000 emergency. Here's a practical, no-BS guide to building your financial safety net in 2026 — whether you're starting with $0 or just getting serious about savings.

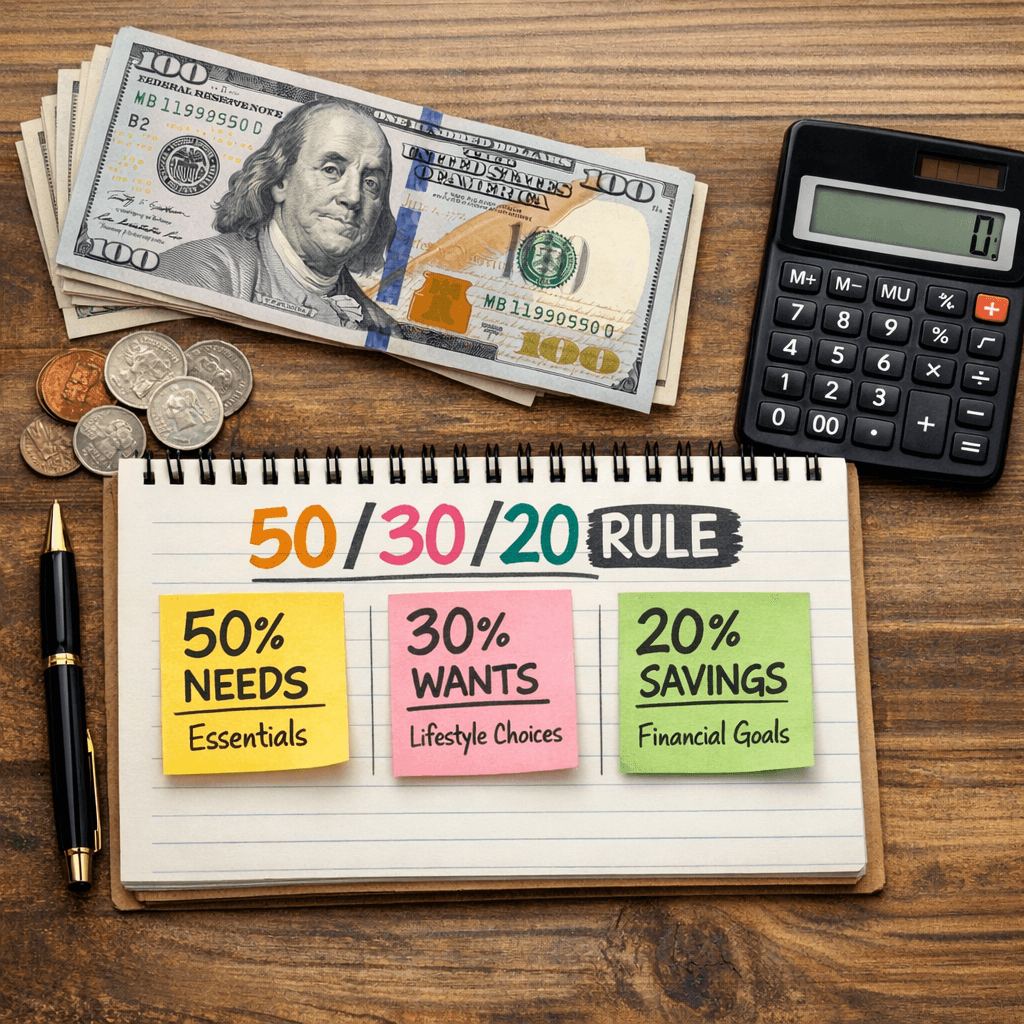

Budgeting

BudgetingThe 50/30/20 Budget Rule Explained (And How to Actually Use It)

The 50/30/20 rule is the simplest budgeting framework that actually works. Here's what it means, how to apply it to your income, and when you might need to adjust it.

Real Estate

Real EstateRent vs. Buy in 2026: The Math That Actually Matters

Should you rent or buy a home in 2026? Forget the emotional arguments. Here's the actual financial math to help you make the right decision for your situation.