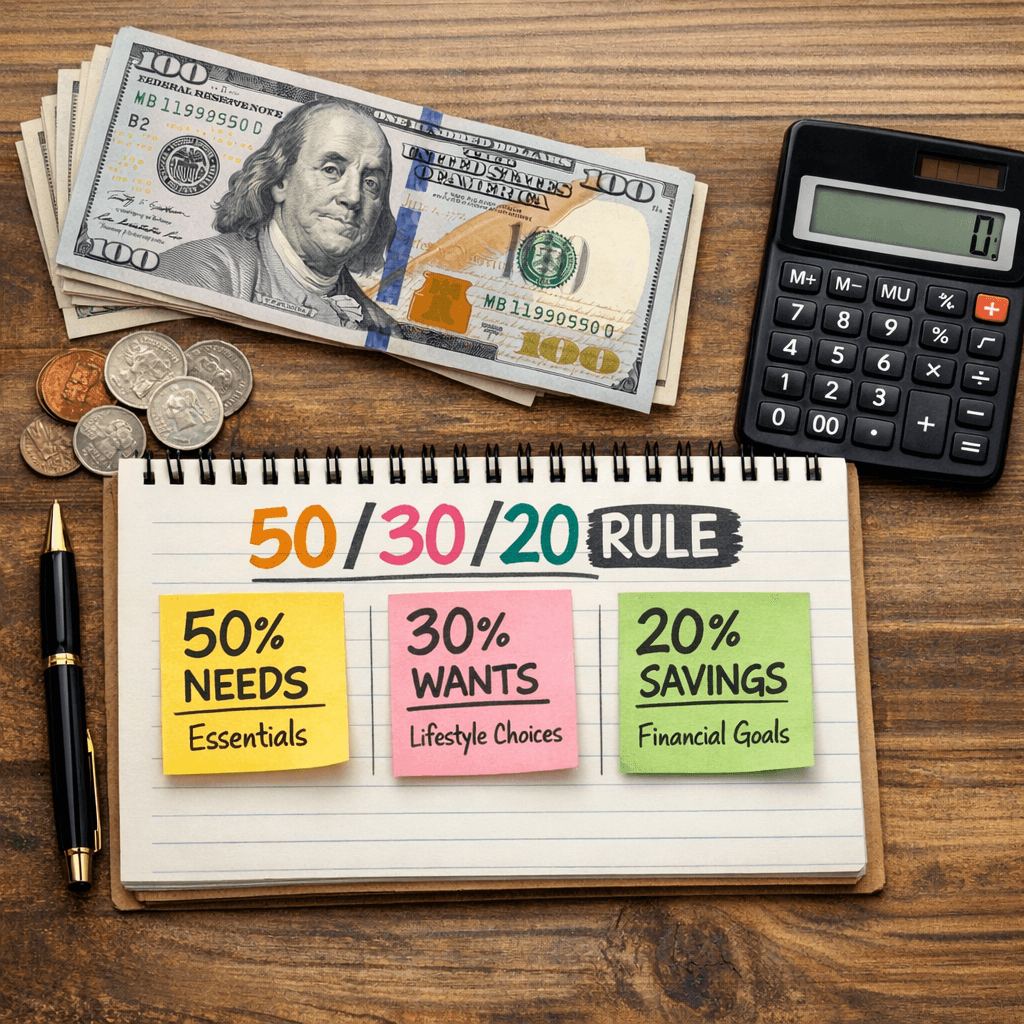

The 50/30/20 Budget Rule Explained (And How to Actually Use It)

The 50/30/20 rule is the simplest budgeting framework that actually works. Here's what it means, how to apply it to your income, and when you might need to adjust it.

John Mitchell

CFP®, CFA

Most budgeting systems are too complicated. They ask you to track every coffee, categorize every transaction, and maintain spreadsheets that would make an accountant cry.

No wonder people give up.

The 50/30/20 rule is different. It's simple enough to remember, flexible enough to work with real life, and effective enough to actually improve your finances.

Here's how it works.

The Basic Framework

Divide your after-tax income into three buckets:

- 50% → Needs (essentials you must pay)

- 30% → Wants (things you enjoy but could live without)

- 20% → Savings & Debt (building wealth and paying off debt)

That's it. Three numbers to remember. One simple framework.

What Counts as "Needs" (50%)

Needs are expenses you can't avoid — the stuff that keeps a roof over your head and food on the table:

- Housing: Rent or mortgage payment

- Utilities: Electric, gas, water, internet (basic, not premium)

- Groceries: Food for home (not restaurants)

- Transportation: Car payment, gas, insurance, public transit

- Insurance: Health, auto, renters/homeowners

- Minimum debt payments: The minimum due on all debts

- Childcare: If required for you to work

The key question: If you lost your job, would you still have to pay this? If yes, it's probably a need.

Example: $5,000/month take-home pay

50% = $2,500 for needs

| Need | Amount |

|---|---|

| Rent | $1,400 |

| Utilities | $150 |

| Groceries | $400 |

| Car payment | $300 |

| Car insurance | $100 |

| Health insurance | $150 |

| Total | $2,500 |

What Counts as "Wants" (30%)

Wants are everything that makes life enjoyable but isn't strictly necessary:

- Dining out and takeout

- Entertainment: Streaming, concerts, movies, games

- Shopping: Clothes (beyond basics), gadgets, hobbies

- Travel: Vacations, weekend trips

- Gym membership

- Subscriptions: Spotify, Netflix, etc.

- Upgraded services: Premium phone plan, faster internet

- Personal care: Salon, spa, etc.

The key question: Could you survive without it? If yes, it's a want.

Example: $5,000/month take-home pay

30% = $1,500 for wants

| Want | Amount |

|---|---|

| Dining out | $300 |

| Entertainment | $150 |

| Streaming services | $50 |

| Shopping | $200 |

| Gym | $50 |

| Travel fund | $400 |

| Misc fun | $350 |

| Total | $1,500 |

What Counts as "Savings & Debt" (20%)

This is the wealth-building category:

- Emergency fund contributions

- Retirement: 401(k), IRA contributions (beyond any employer match)

- Investments: Brokerage account contributions

- Extra debt payments: Anything above the minimum (paying down credit cards, student loans faster)

- Saving for goals: House down payment, car fund, etc.

The key insight: Your employer's 401(k) match is free money, but it doesn't count here — this 20% is what YOU contribute from your paycheck.

Example: $5,000/month take-home pay

20% = $1,000 for savings & debt payoff

| Savings/Debt | Amount |

|---|---|

| 401(k) contribution | $400 |

| Roth IRA | $300 |

| Emergency fund | $200 |

| Extra student loan payment | $100 |

| Total | $1,000 |

How to Apply It: Step by Step

Step 1: Calculate your after-tax income This is your take-home pay — what actually hits your bank account. If you're a W-2 employee, it's your net pay. If you're self-employed, estimate after setting aside money for taxes.

Step 2: Calculate your targets

- Needs: Income × 0.50

- Wants: Income × 0.30

- Savings: Income × 0.20

Step 3: Categorize your current spending Look at last month's bank and credit card statements. Put each expense in one of three buckets.

Step 4: Compare reality to targets Where are you over? Where are you under?

Step 5: Adjust If needs are over 50%, look for ways to reduce (cheaper housing, refinance, etc.). If wants are eating into savings, find cuts. If you're crushing it on savings, maybe you can relax on wants.

When 50/30/20 Doesn't Work

This rule is a guideline, not a law. Here's when you might need to adjust:

High cost-of-living areas: In NYC, SF, or Boston, housing alone might eat 40% of your income. You might need 60/20/20 or 55/25/20 just to survive. That's okay — adapt the rule to your reality.

Aggressive debt payoff: If you're attacking credit card debt or student loans, you might do 50/20/30 (flipping wants and savings). Temporary pain for long-term gain.

High earners: If you make $200K, you probably don't need 30% for wants. Consider 50/20/30 (with 30% to savings) or even more aggressive.

Low income: If you're struggling to cover needs, the 20% savings target might not be realistic yet. Focus on building income and reducing needs first. Even $50/month to savings is progress.

Young and aggressive: In your 20s with no kids? Maybe go 50/25/25 or even 50/20/30 to supercharge your investments while you can.

The Gray Areas

Some expenses are tricky to categorize:

Cell phone: Basic plan = need. Unlimited everything with new iPhone financing = mostly want.

Clothes: Basic work clothes = need. New sneakers because yours are "old" = want.

Car: Reliable transportation = need. BMW when a Honda works = want.

Food: Groceries = need. Groceries from Whole Foods when Aldi is down the street = partially want.

Be honest with yourself. You know the difference.

Why This Works

The 50/30/20 rule works because it:

-

Gives you permission to spend. 30% on wants is healthy and sustainable. You won't burn out.

-

Prioritizes savings. 20% automatically means you're building wealth. No negotiation.

-

Creates natural limits. You can't overspend on wants without visibly blowing the budget.

-

Requires minimal tracking. Three buckets, not thirty categories.

-

Adapts to income changes. Got a raise? Buckets grow proportionally.

Tools to Help

You don't need fancy software, but these can help:

- YNAB (You Need A Budget): Great for detailed budgeting, $99/year

- Monarch Money: Modern, clean interface, links all accounts

- A simple spreadsheet: Free, customizable, just requires discipline

- The envelope method: Physical cash in labeled envelopes (old school but effective)

The Bottom Line

Budgeting doesn't have to be complicated. The 50/30/20 rule gives you a framework that's simple enough to remember, flexible enough for real life, and powerful enough to build wealth.

Your action plan:

- Calculate your take-home pay

- Run the 50/30/20 math

- Review last month's spending

- See where you stand

- Make one adjustment this week

You don't need to be perfect. You just need to be intentional. Even getting close to 50/30/20 puts you ahead of most people.

What's your biggest budgeting challenge? Drop it in the comments — I'll help you figure it out.

Continue Reading

More from Budgeting

Budgeting

BudgetingHow to Build an Emergency Fund in 2026 (Even If You're Starting From Zero)

57% of Americans can't cover a $1,000 emergency. Here's a practical, no-BS guide to building your financial safety net in 2026 — whether you're starting with $0 or just getting serious about savings.

You May Also Find Interesting

Crypto

CryptoBitcoin for Beginners: What You Need to Know in 2026

Curious about Bitcoin but confused by the jargon? Here's a plain-English guide to what Bitcoin is, how it works, and whether it belongs in your portfolio.

Real Estate

Real EstateRent vs. Buy in 2026: The Math That Actually Matters

Should you rent or buy a home in 2026? Forget the emotional arguments. Here's the actual financial math to help you make the right decision for your situation.

Retirement

Retirement401(k) Basics: Everything You Need to Know in 2026

Your employer offers a 401(k). Should you use it? How much should you contribute? What's a match? Here's the complete beginner's guide to the retirement account that could make you a millionaire.

Credit

CreditWhat's a Good Credit Score? The Numbers That Actually Matter in 2026

Your credit score affects everything from mortgage rates to job applications. But what's actually "good"? Here's what the numbers mean and what lenders really look for in 2026.