How to Start Investing With $100 (A Beginner's Guide for 2026)

You don't need thousands to start investing. With just $100 and a smartphone, you can begin building wealth today. Here's exactly how to do it step by step.

John Mitchell

CFP®, CFA

"I don't have enough money to invest."

I hear this constantly. And 20 years ago, it was kind of true. Brokerages had minimums. Commissions ate your profits. Buying a single share of Amazon wasn't an option for most people.

Today? You can start investing with $100. Or $50. Or even $1.

The barriers are gone. The only thing stopping you is... starting.

Why $100 Is Enough

Here's what's changed:

- Fractional shares — You can buy a piece of any stock, no matter the price

- Zero commissions — Most brokerages don't charge trading fees anymore

- No minimums — Many platforms let you open an account with $0

- Easy apps — Invest from your phone in minutes

That $100 won't make you rich overnight. But it will do something more important: it'll get you in the game. And once you're in, you can build.

Step 1: Choose a Brokerage

You need an account to invest. Here are the best beginner-friendly options in 2026:

Fidelity

- No minimums, no fees

- Fractional shares ("Stocks by the Slice")

- Excellent research tools

- Great for long-term investors

Charles Schwab

- No minimums, no fees

- Fractional shares (Schwab Stock Slices)

- Strong customer service

- Recently merged with TD Ameritrade

Robinhood

- Designed for beginners

- Clean, simple interface

- Fractional shares available

- Good for learning, but consider graduating to Fidelity/Schwab later

Acorns

- Rounds up purchases and invests the change

- Good for hands-off beginners

- Small monthly fee ($3-5)

My recommendation for pure beginners: Fidelity. It's free, powerful, and you won't outgrow it.

Step 2: Open Your Account (10 Minutes)

You'll need:

- Social Security number

- Bank account for transfers

- Basic personal info

Choose a taxable brokerage account to start. (If you want tax advantages and won't touch the money until retirement, open a Roth IRA instead — same process.)

Link your bank account and transfer your first $100.

Step 3: Decide What to Buy

This is where beginners get paralyzed. Thousands of options. Which one?

Keep it simple. Here are three approaches:

Option A: One ETF (Easiest)

Buy a single broad market ETF and you're instantly diversified across hundreds of companies:

- VTI (Vanguard Total Stock Market) — Owns the entire U.S. stock market

- VOO (Vanguard S&P 500) — Owns the 500 largest U.S. companies

- SCHB (Schwab U.S. Broad Market) — Similar to VTI, very low cost

With fractional shares, you can buy $100 of VTI even though one share costs ~$270.

This is the "set it and forget it" approach. Warren Buffett himself recommends S&P 500 index funds for most investors.

Option B: Target Date Fund (Even Easier)

If you're investing in a Roth IRA, you might consider a target date fund like:

- Fidelity Freedom 2055 (if you plan to retire around 2055)

- Vanguard Target Retirement 2050

These automatically adjust from aggressive to conservative as you age. One fund, done.

Option C: Individual Stocks (More Involved)

Want to own specific companies? With fractional shares, you could split your $100:

- $25 in Apple

- $25 in Microsoft

- $25 in Amazon

- $25 in Nvidia

This is riskier than an ETF because you're less diversified. But it can be a good learning experience if you're interested in understanding individual companies.

My suggestion: Start with Option A (a broad ETF), then add individual stocks later as you learn.

Step 4: Actually Buy It

In your brokerage app:

- Search for the ticker (e.g., "VTI")

- Click "Buy"

- Enter dollar amount ($100)

- Confirm the order

That's it. You're now an investor.

Step 5: Automate and Keep Going

Here's the secret: $100 once won't change your life. $100 every month will.

Set up automatic recurring investments:

- Most apps let you auto-invest weekly or monthly

- $25/week = $1,300/year

- $100/month = $1,200/year

At a 7% average annual return:

- $100/month for 10 years = ~$17,400

- $100/month for 20 years = ~$52,000

- $100/month for 30 years = ~$122,000

The earlier you start, the more time does the heavy lifting.

What NOT to Do

Don't try to time the market Nobody consistently predicts short-term moves. Just invest regularly regardless of what the market is doing.

Don't panic sell The market will drop. Sometimes a lot. That's normal. Stay the course.

Don't day trade With $100, frequent trading will just generate losses and frustration. Think long-term.

Don't invest money you need soon Only invest money you won't need for 5+ years. Keep your emergency fund separate.

Don't fall for "hot tips" If someone on TikTok promises 1000% returns, run. Boring index funds beat most stock pickers over time.

Taxes: What You Need to Know

In a regular brokerage account:

- You'll owe taxes on dividends (usually small)

- You'll owe capital gains tax when you sell at a profit

- Long-term gains (held 1+ year) are taxed lower than short-term

In a Roth IRA:

- No taxes on gains ever (as long as you wait until 59½ to withdraw)

- This is why Roth IRAs are so powerful for young investors

The Bottom Line

Starting to invest with $100 isn't about getting rich quick. It's about building a habit that compounds over decades.

Your action plan:

- Download Fidelity (or your preferred app)

- Open a brokerage account

- Transfer $100

- Buy VTI or VOO

- Set up monthly auto-invest

- Don't touch it

That's the whole game. The best time to start was 10 years ago. The second best time is today.

First time investing? Tell me what you bought in the comments — I'd love to hear what you picked.

You May Also Find Interesting

Crypto

CryptoBitcoin for Beginners: What You Need to Know in 2026

Curious about Bitcoin but confused by the jargon? Here's a plain-English guide to what Bitcoin is, how it works, and whether it belongs in your portfolio.

Budgeting

BudgetingHow to Build an Emergency Fund in 2026 (Even If You're Starting From Zero)

57% of Americans can't cover a $1,000 emergency. Here's a practical, no-BS guide to building your financial safety net in 2026 — whether you're starting with $0 or just getting serious about savings.

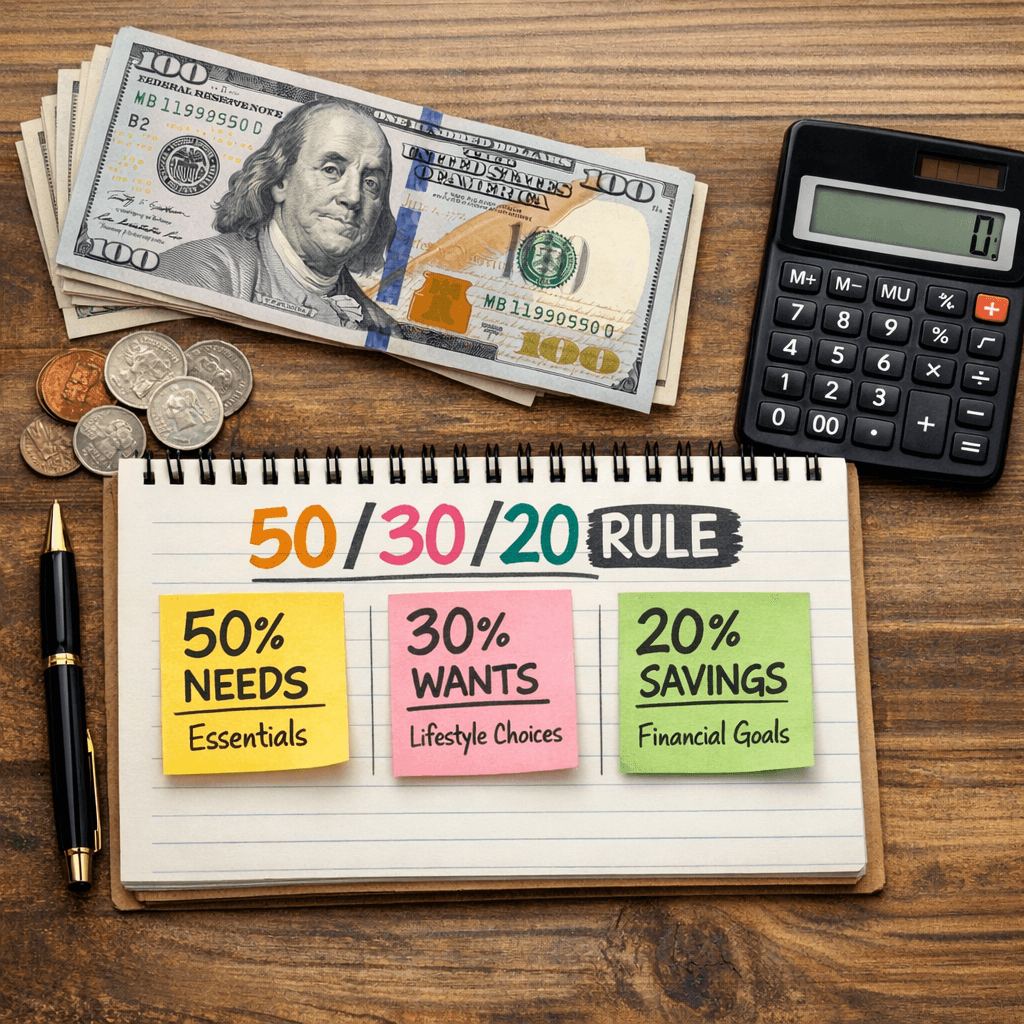

Budgeting

BudgetingThe 50/30/20 Budget Rule Explained (And How to Actually Use It)

The 50/30/20 rule is the simplest budgeting framework that actually works. Here's what it means, how to apply it to your income, and when you might need to adjust it.

Real Estate

Real EstateRent vs. Buy in 2026: The Math That Actually Matters

Should you rent or buy a home in 2026? Forget the emotional arguments. Here's the actual financial math to help you make the right decision for your situation.